Last week, the U.S. Supreme Court agreed to take up South Dakota’s lawsuit against Wayfair Inc., Overstock.com Inc. and Newegg Inc. If the court overturns current law, state and local governments could collect online sales tax from all online retailers, even if they don’t have a physical presence in their states. Internet Retailer asked retailers and consumers how they think a ruling—expected by the end of June after arguments this spring—will impact them. Here are the results.

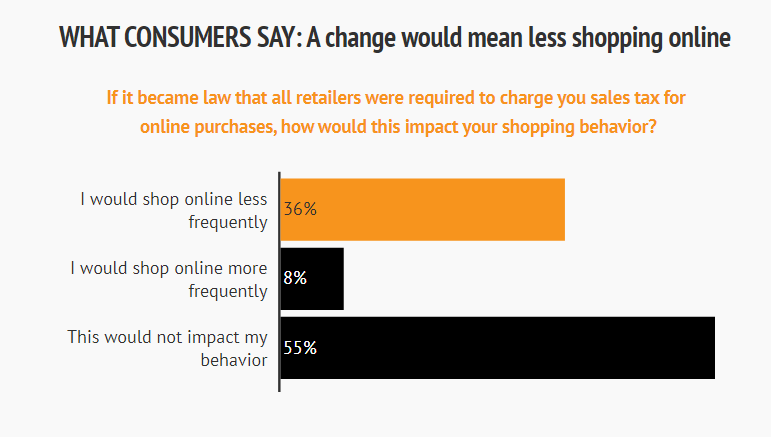

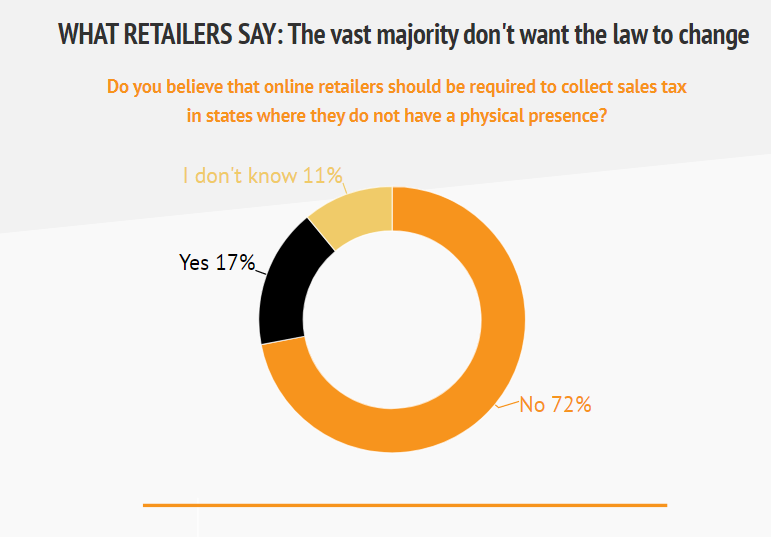

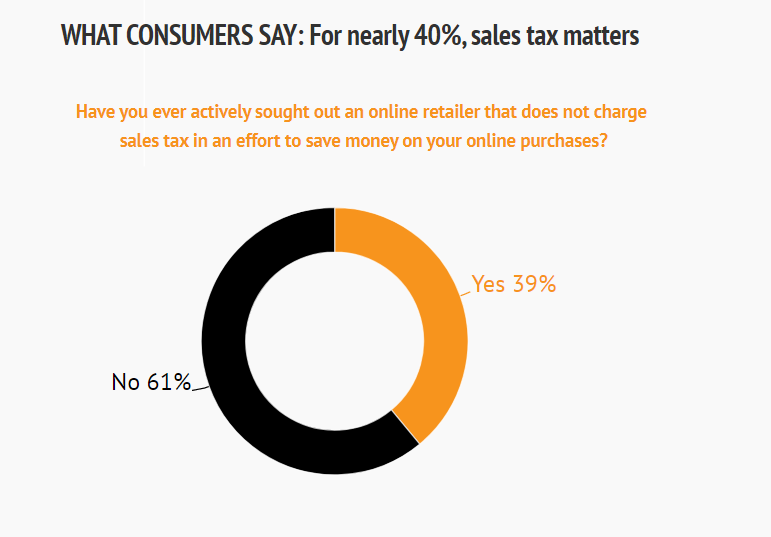

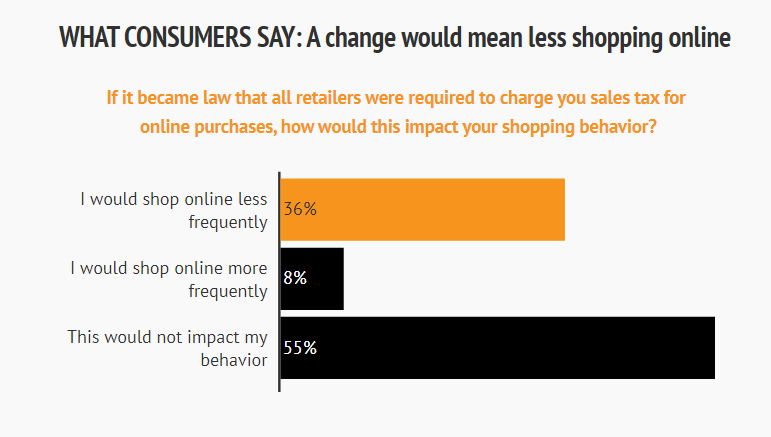

Any decision from the U.S. Supreme Court on the State of South Dakota’s case against Wayfair, Overstock and Newegg could change the way retailers collect sales tax for online orders. Currently, retailers are only required to collect sales tax for purchases originating in states where they operate a physical presence. For small online retailers, this has been a major leg up against Amazon, which has fulfillment centers in most U.S. states and therefore collects sales tax on nearly all online orders, as well as retail chains like Walmart with large nationwide store footprints. For retailers ranked in the Internet Retailer Top 1000, the median number of states in which sales tax is collected is three. That could all change if the court finds that a 1992 U.S. Supreme Court decision, generally known as Quill Corp. v. North Dakota, doesn’t apply to web merchants. The court ruled that Quill, a catalog retailer, did not have to collect sales tax in North Dakota where it had no physical presence. In the few days since the court’s announcement to hear South Dakota’s case, Internet Retailer has surveyed online retailers and consumers to gauge feelings about how a decision may impact retailers’ businesses and consumers’ shopping habits. The results are below.

Quotes from retailers:

Atinc Sonmezer, CEO

MEDA Brands, MissBellyDance.com

“We will need to file monthly sales tax for each county (roughly 14,000 counties). It will be very costly. Not sure how small businesses selling on Amazon nationwide will be able to handle it.”

Roger Williams, Owner

LotionsByDesign.com

“We would very likely be forced to use a 3rd party tax service (cost?) and of course the enforcement of such a tax collection would mean some type of info exchange that I can’t even…. We are a tiny business making next to nothing so entirely reasonable to think of going out of business. Close to half of our business is out of state.”

Deb Beresford, E-Commerce Manager

X-Wear.com and AmericanSunglass.com

In the last two years, many of the sunglasses brands that we sell “have changed their policies to require their retailers to maintain MAP (minimum advertised pricing). Because we can no longer discount most of these sunglasses, we lost huge revenue on the marketplaces where we listed our products. The only reason I believe we capture any out-of-state customers is because they don’t have to pay sales tax. It’s very hard to find an edge in this market now without the courts taking away the one thing that gives any of us a fighting chance.”